Described the Gaap and Gaas Used to

Read customer reviews find best sellers. As amended effective December 2005 by SAS No.

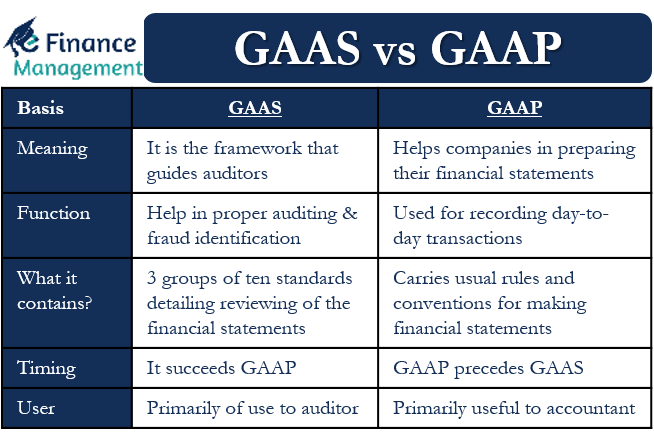

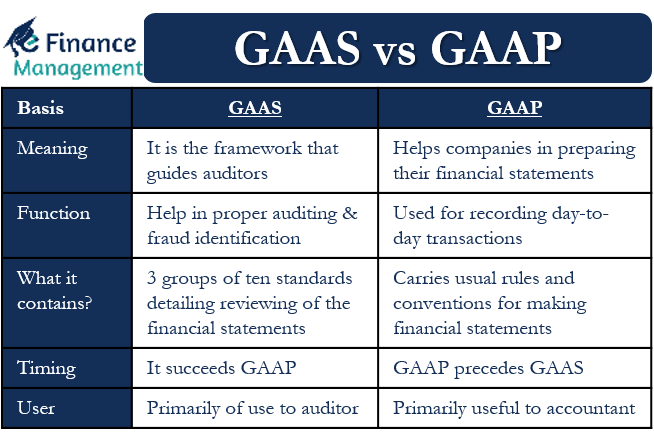

Gaas Vs Gaap Differences Meaning Functions Users Content Timing

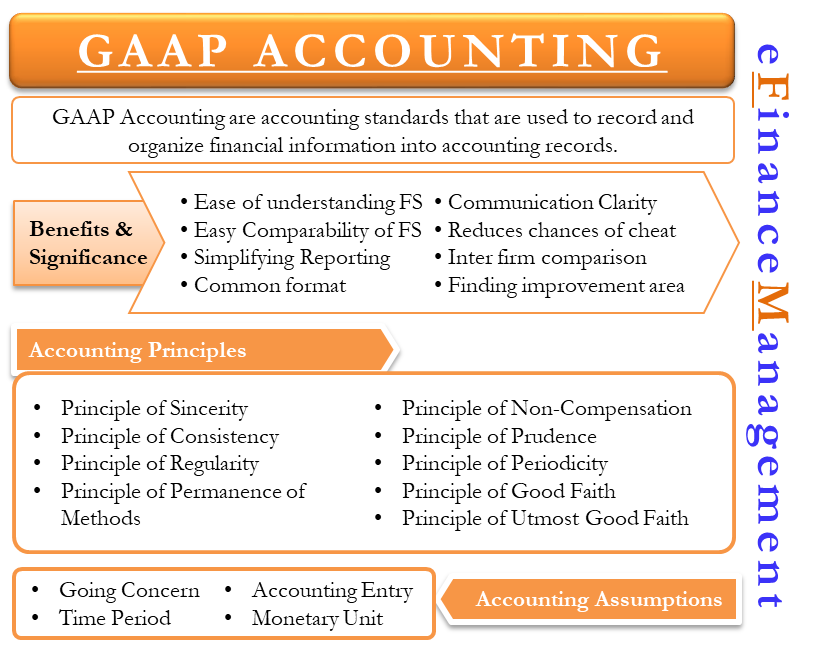

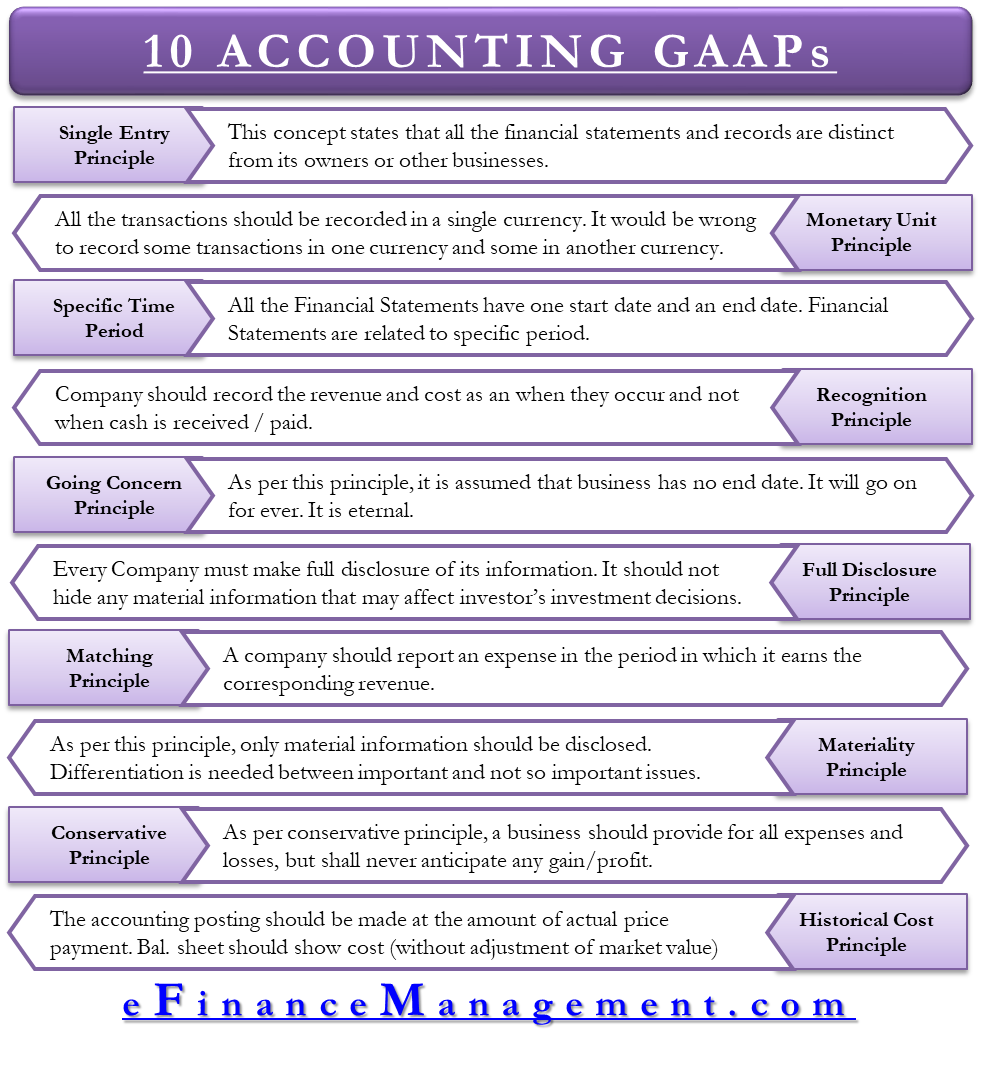

The common set of procedures accounting principles and standards that companies use to compile their financial statements.

. These principles methods and procedures deal with how to audit a company. Securities and Exchange Commission SEC. Generally accepted accounting principles.

Here usually means those generally used in the United States otherwise specific country should be identified. As amended effective for audits of financial statements for periods beginning on or after December. Generally Accepted Auditing Standards GAAS Generally Accepted Accounting Standards GAAS are also specific guidelines governing the preparation of financial statements.

GAAS are auditing standard that are meant for auditors to help ensure in transparent and unbiased auditing. Recognize which SAS provides guidance with respect to audit evidence. Accountants professional liability-related investigations and consulting involving questions of compliance with Generally Accepted Auditing Standards GAAS established by the American Institute of Certified Public Accountants AICPA Public Company Accounting Oversight Board PCAOB Auditing Standards and Generally Accepted Accounting Principles GAAP.

The continuing education workshop will discuss. GAAS is generally accepted auditing standards. Generally Accepted Accounting Principles GAAP or US.

Provide a list of the types of unmodified and modified audit opinions. GAAS Generally Accepted Auditing Standards. The hierarchy of GAAP is an outline for determining the most appropriate sources for obtaining guidance on US.

GAAP are a combination of authoritative standards ie. QUESTION 37 The guidelines that describe the rules of accounting are called. For GAAS the following standards exist.

Failure to Comply with GAAP and GAAS Standards As an individual or small business owner you place your trust in your accountant your auditor your CPA and other financial professionals. FASB GAAP QUESTION 38 Respectively Accounts Receivable Salary Expense and Salary Payable are. GAAP is codified by FASB the financial accounting standards Board.

NASBA Field of Study Accounting 1 hour Auditing 1 hour Program Prerequisites Basics of CIRA accounting. GAAP GAAS and SSARS standards are also important in the industry. GAAP is generally accepted accounting principles.

Designed to keep you up to date on recent activity in GAAP GAAS SSARS this virtual CPE workshop will summarize recent updates in GAAP GAAS SSARS introduced in 2021 year to date. Generally accepted auditing standards GAAS are a set of systematic guidelines used by auditors when conducting audits on companies financial records ensuring the accuracy consistency and verifiability of auditors actions and reports. New more complex accounting issues and disclosures create challenges for todays busy financial executives.

Hierarchy Of GAAP. GAAP involves the principal methods and procedures for financial reporting of publicly traded companies. On the other hand GAAS is used by the auditor.

Some of the methodology used in the accounting department to compile the financial statements may not comply with generally accepted accounting principles GAAP. After the auditor reviews the financial statements the auditor may ask for clarifications from the accountant. 1 The auditor must state in the auditors report whether the financial statements are presented in accordance with generally accepted accounting principles GAAP 2 the auditor must identify in the auditors report those circumstances in which such principles have not been consistently observed in.

In some cases this trust can be misplaced and you could. A businesss accountant uses GAAP to prepare financial statements and carry out other accounting-related tasks. While GAAP is a frequently used financial reporting framework GAAS is a set of auditing standards not a financial reporting framework.

GAAP Generally Accepted Accounting Principles. GAAP pronounced like gap is the accounting standard adopted by the US. Ad Browse discover thousands of brands.

Generally accepted auditing standards GAAS provides three categories of standards and ten standards by which an audit should be performed. Generally Accepted Auditing Standards 1601 how the alternative procedures performed in the circumstances were suffi-cient to achieve the objectives of the presumptively mandatory requirement. GAAP are generally accepted accounting principles that are a set of guidelines for the companies to help them in preparing financial statements according to a standard.

GAAP or Generally Accepted Accounting Principles is a commonly recognized set of rules and procedures designed to govern corporate accounting and financial reporting SEC Filings SEC filings are financial statements periodic reports and other formal documents that public companies broker-dealers and insiders are required to submit to the US. All permanent accounts permanent temporary and permanent accounts temporary permanent and temporary accounts permanent temporary and temporary accounts. While the SEC previously stated that it intends to move from US.

Set by policy boards and simply the commonly accepted ways. GAAP to the International Financial Reporting Standards IFRS the latter differ considerably from GAAP and progress has been. REPORTS with UNMODIFIED OPINIONS.

A CPA or audit firm will also use the GAGAS when conducting performance audits used to evaluate the performance of a program or project.

Generally Accepted Auditing Standards Gaas

Gaap Accounting All You Need To Know Efinancemanagement

What Are All 10 Gaap Principles Origin Brief Description Of Each Efm

Comments

Post a Comment